March 31, 2024

Cox Farms’ launch announcement was a bright spot in a slow March. Urban-gro’s successful diversification strategy is the highlight of the earnings season so far.

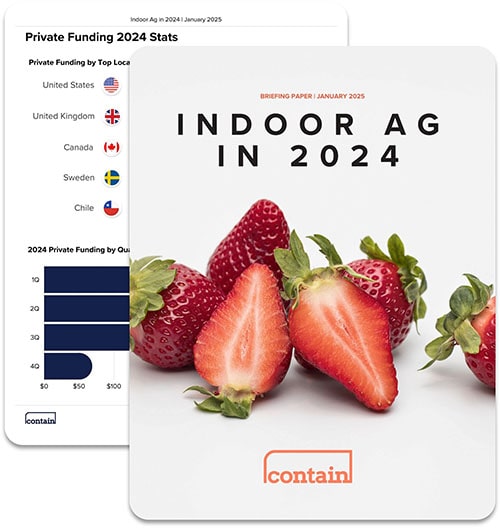

1. Private funding was glacial in March

We tracked just one private funding round in the month, and it was again for a tech firm. AgriData Innovations, based in Delft, secured undisclosed funding from its existing investors on February 15, 2024. This investment aims to scale up operations, accelerate market expansion, and enhance their AI-powered crop monitoring technology for greenhouses.

It’s unsurprising to see an AI-angle to this month’s raise as that’s the one area that remains enticing to investors as we’ve written about elsewhere. The renewed focus on profitability and operational efficiency plays against indoor agriculture’s strengths, as profitable startups in the sector remain sadly rare.

With waves of layoffs hitting tech and finance, some market commentators had pinned hopes on a reopening of the IPO market. IPOs return funds to investors that can then be redeployed into new investments. The recent listing of social forum firm Reddit has been seen as a bellwether. A slew of other listings are expected to follow if successful. The stock is trading below its IPO price as at time of writing.

The other potential catalyst is a drop in interest rates, which about half of the market expects by June. According to a March 28 CNBC article: “Traders are currently pricing in a roughly 55% chance of a first Fed rate cut taking place in June, according to the CME FedWatch Tool. That’s down from nearly 70% last week.”

2. A new farm opening buoyed industry sentiment

Our Indoor Ag Buzz Index™ combines the popularity of a range of indoor farm-related phrases in the media into an index. It ticked down this month, but there was a significant bright spot:

On March 26, 2024, Cox Enterprises announced the launch of Cox Farms, “a new business focused on sustainable food and agriculture”. The move follows its acquisition of Brightfarms and Mucci Farms. It’s encouraging to see a company with a vision, and the capital to back it, make moves in the sector.

3. The listed sector had a busy month

Our proprietary Indoor Ag Stock Index™ had another good month, up 92 points over NASDAQ performance year-on-year. This was aided by rebounds from companies like Gibraltar Inds (owners of greenhouse manufacturer Rough Bros) and Village Farms after their results. The performance of the Japanese firms in the index remains strong also.

Canadian SPAC Agrinam Acquisition Corp’s planned acquisition of container farm company Freight Farms got a reprieve with a further six month extension of its fundraising period to September 15, 2024. It had earlier filed an amended prospectus that showed an 11% fall in revenue and 30% fall in gross profit for Freight Farms in the three months to September 2023 vs the prior year.

Elsewhere, Canadian grow system firm CubicFarm Systems successfully closed the final tranche of its private placement financing on March 18, 2024. In total, it raised C$2.06m ($1.52m). The company will use proceeds from this financing for general working capital and administrative purposes.

Earnings Results So Far

We’re midway through earnings results season in the public sector. The stand out so far is Urban-gro’s revenue increase thanks to its diversification away from the cannabis market. Here’s a summary of what’s been reported so far:

GrowGeneration Corp.

GrowGeneration Corp. announced its Q4 2023 earnings on March 13, 2024. The company reported an earnings per share (EPS) of $-0.18, which fell short of the expected $-0.12 EPS. In their report, they highlighted a 19% improvement in gardening and cultivation sales in January compared to December of the previous year. They also noted that private label sales accounted for over 20% of revenue in January. GrowGeneration is focusing on expanding its brand portfolio, attracting a larger customer base, and putting profitability at the forefront for 2024. They expect net revenue to be in the range of $205 million to $215 million, with an adjusted EBITDA ranging from a $2 million loss to a $3 million profit.

iPower Inc.

iPower Inc. made its most recent earnings announcement for the second quarter last week, as of the article dated February 17, 2024. iPower Inc. reported its second-quarter results, revealing revenues of $17 million, which was 31% below expectations. The company also reported a per-share statutory loss of $0.06, 20% worse than what analysts had anticipated. Following these results, analysts adjusted their forecasts, now estimating $83.2 million in revenue for 2024, which would be a 4.3% decline from the previous year. They also expect losses to decrease, predicting a loss of $0.20 per share.

Urban-gro

Urban-gro, Inc. reported a 6.7% increase in revenue to $71.5 million for the year 2023 compared to the previous year, despite a wider net loss of $(18.7) million. The company anticipates stronger revenues exceeding $84 million in 2024, representing at least a 17.4% growth. It expects to achieve positive Adjusted EBITDA. The company described the 2023 results as transitional, with 70% of revenues derived from diversified commercial sectors outside of cannabis. This demonstrates the benefit of its diversification strategy despite project delays and a backlog of $110 million entering 2024.

Village Farms

Longtime tomato grower Village Farms pivoted to cannabis in 2017. It announced a 14% increase in sales for 2023, thanks to a strong performance in its Canadian cannabis division. Gross margins increased from 1% in 2022 to 23% in 2023. The results include an encouraging sign for food producers. The company is restarting production at one of its tomato facilities for the 2024 season.

Safe Harbor Language

The information provided on this blog is for general informational purposes only. It is not intended to be a comprehensive analysis of the securities, markets, or developments referred to. While we strive to ensure the accuracy and reliability of the information, the content of this blog does not constitute financial advice, investment advice, trading advice, or any other advice. You should not treat any of the blog’s content as such.

We do not recommend that any securities listed or discussed be bought, sold, or held by you. Nnothing on this blog should be taken as an offer to buy, sell, or hold securities. Please conduct your own due diligence and consult with a qualified financial advisor before making any investment decisions. Forward-looking statements made in this blog are only predictions. They are subject to risks, uncertainties, and assumptions that are difficult to predict. Therefore, actual results may differ materially from those expressed in forward-looking statements. We expressly disclaim any obligation to update or alter statements whether as a result of new information, future events or otherwise, except as required by law.

Indoor Agriculture Pivots to Home Gardens as Vertical Farming Failures Drive Strategic Reevaluation

Zordi Series B and May 2025 Indoor Agriculture Developments

Freight Farms Bankruptcy and iUNU’s $20M Raise Highlight April’s Indoor Ag Contrasts

Freight Farms Resources: Indoor Ag Companies Stepping Up to Support Freight Farmers

How to Finance Your Hydroponic Project in 2025: Finding Opportunity in a Shifting Market

Indoor Ag’s New Reality: Practical Advice from Investment Banker Adam Bergman

Plenty Unlimited bankruptcy dominates March’s indoor ag news, overshadowing new farm plans

80 Acres Farms secures $115m, Square Roots expands to Japan, and indoor ag sees farm shakeups in February

Robobees take flight, vanilla goes vertical, and a new IPO is on the horizon in indoor agriculture’s January

Canadian Agriculture Grants: 7 Funding Opportunities for Indoor Farming in 2025

Indoor Ag Outlook: Funding Trends and 2025 Projections