January 8, 2024

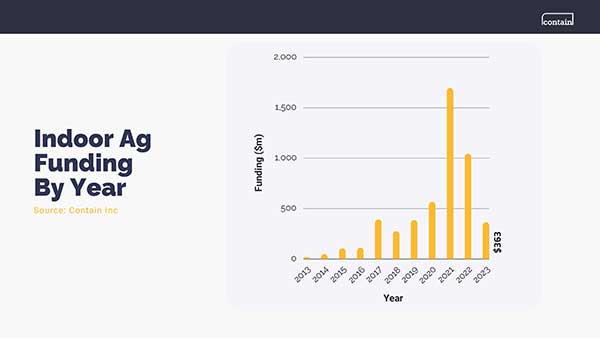

In many ways, 2023 was an “annus horribilis” for CEA funding. As interest rates rose and venture capitalists retreated from the market, multiple vertical farms and greenhouse firms closed up shop.

Reasons for Decline

There are plentiful theories as to this decline. Some argue that vertical farms will never be economically viable. This argument misses the basic truth that some indoor farms, including ones that Contain works with every day, are in fact profitable and sustainable. Too little work has been done on the exogenous factors, in particular, that influence a farm’s profitability. It’s not clear, for instance, that big is necessarily better when it comes to specialty crop farms. What scales on paper doesn’t always scale well in the field or container farm. Indoor farms are far from the only ones impacted by the complexities of farming. Nationally, only a fifth of all farming household income comes from farm income, according to the USDA.

The most common explanation for failures has been farms’ inability to master their largest costs, namely electricity and labor. Less noted is the impact that inflation has had on these costs, and on farm construction costs and timelines. For example, industrial and commercial electricity prices are up 20% in the past three years, wholesale Boston lettuce prices only 14%.1

Role of Venture Capital

Investors’ pull back from the market has doubtless been part of the challenge. Some firms’ focus was on getting to the next venture round before their competitors. Venture capital mostly funded one business model in the last cycle; vertical farms that planned to use proprietary technology to gain an edge in large scale farming, initially of leafy greens and then of more challenging crops. According to the Guardian, there are more than 2,000 indoor farms in the US and fewer than 100 have publicly announced investor rounds (our figure). Their failure may be more noticeable, but it is certainly not representative of the entire market. At Contain, we see far more diverse business models, from multi-generational ranches adding winter growing capacity to consumer goods companies growing some of their own feedstock.

Download our briefing paper “2023 In Review” for charts and tables detailing CEA funding in the private market, stock market performance and M&A in greenhouses. We also cover farm closures and bankruptcies and new farm projects in crops like saffron, berries and coffee.

Reasons for Hope

On the ground, the team at Contain of course sees the challenges that farmers tackle every day. But we see signs of hope for the industry with investors still willing to invest in technological developments, as we highlight at the tail end of this briefing paper, and farms that serve their local communities.

Footnote:

- 1. Electricity comparison is based on EIA data for October 2023, most recent available. Same dates for wholesale terminal prices from USDA for weeks of October 21, 2023 and October 24, 2020.

August Indoor Ag Update: M&A Galore & Indoor Specialty Crops Funding

July Indoor Ag Update: Acquisitions Accelerate & Funding Returns

Five Farms Making a Go of Indoor Agriculture

Dyson’s 250% Yield Breakthrough Headlines June AgTech: Vertical Farming Advances, M&A Activity, and Industry Setbacks

Indoor Agriculture Pivots to Home Gardens as Vertical Farming Failures Drive Strategic Reevaluation

Zordi Series B and May 2025 Indoor Agriculture Developments

Freight Farms Bankruptcy and iUNU’s $20M Raise Highlight April’s Indoor Ag Contrasts

Freight Farms Resources: Indoor Ag Companies Stepping Up to Support Freight Farmers

How to Finance Your Hydroponic Project in 2025: Finding Opportunity in a Shifting Market

Indoor Ag’s New Reality: Practical Advice from Investment Banker Adam Bergman

Plenty Unlimited bankruptcy dominates March’s indoor ag news, overshadowing new farm plans