September 8, 2024

CEA’s environmental impact was reassessed this month thanks to a new academic study. Though funding was slow, there were acquisitions and new partnerships announced.

1. A quiet month for private funding

August is usually a quiet month for funding, and this year was no different. We tracked just one significant funding event in the month.

The USDA’s National Institute of Food and Agriculture (NIFA) has awarded a $300,000 grant to the Arkansas Center for Food Safety to improve food safety in hydroponic lettuce production. This research is timely, as hydroponic lettuce production has expanded significantly in recent years. According to a USDA report, hydroponic lettuce production grew from 15.4m lbs in 2014 to 36.4m lbs by 2019. Given this rapid growth, we need to understand the risks posed by pathogens and pests in soilless substrates used in hydroponic systems. The project aims to develop best practices for mitigating these risks, which will be shared with growers through training and workshops.

2. CEA’s environmental impact challenged

Our Indoor Ag Buzz Index™ combines the popularity of a range of indoor farm-related phrases in the media into an index. The index was again down by month end, with just a handful of announcements.

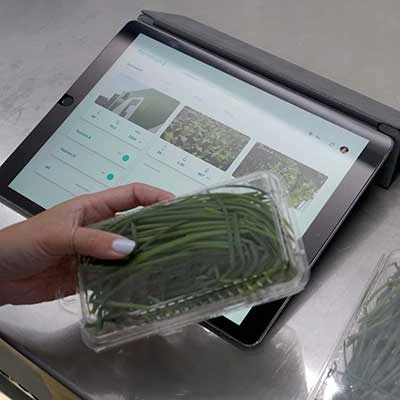

Plenty Ag deal with 7-Eleven

7-Eleven has expanded its partnership with Plenty Inc, a vertical farming major, to offer sustainably grown fresh produce in select stores. The collaboration focuses on increasing access to locally sourced, pesticide-free produce grown in controlled environments. This effort aligns with 7-Eleven’s goal of providing fresher, more sustainable options to its customers. This will come in the form of pre-packaged salads. Plenty’s Compton farm will likely supply the produce. The partnership currently serves locations in Southern California, with plans for further expansion.

New study on CEA’s environmental impact

Elsewhere, a new study suggests that CEA’s environmental impact, specifically vertical farming, may be lower than previously estimated. The study, conducted by researchers at Cornell University, found that improvements in energy efficiency, water usage, and technology are contributing to a reduced carbon footprint for these farms. By optimizing light sources, reducing waste, and leveraging renewable energy, vertical farms can potentially achieve greater sustainability. This finding provides a more hopeful outlook for CEA’s role in sustainable agriculture, challenging earlier assumptions about its environmental cost.

Finally, Toronto-listed SPAC Agrinam Acquisition Corp announced that it is seeking an extension to its business combination agreement with Freight Farms, a container farming company, beyond the current September 15, 2024 deadline. The proposed new deadline is December 15, 2024. The merger deal, valued at $147 million, includes Freight Farms exchanging all of its shares for equity in the combined entity. As part of this transaction, Agrinam has already delivered $4 million to Freight Farms and is seeking an additional $16 million from strategic investors. It is requesting that current investors give more time to complete the deal. A SPAC, or special purpose acquisition company, raises capital through an IPO to acquire an existing business.

3. Acquisitions and stronger results in the listed sector

Our proprietary Indoor Ag Stock Index™ ended the month down just under 10% year on year. The index also significantly underperformed NASDAQ during the period.

There were three notable news announcements in the listed sector this month:

- Agriforce (ticker: AGRI) a Canadian agtech company, has acquired Radical Clean Solutions (RCS). RCS focuses on sustainable, environmentally friendly cleaning products. This acquisition helps Agriforce expand its agricultural and biotechnology portfolio. RCS offers patented, non-toxic cleaning technology for agriculture and other industries. The acquisition is part of a broader acquisition trend in agtech as less plentiful funding forces corporate shifts.

- Light Science Technologies (ticker: AIM:LST) discussed its recent performance and strategy in an interview. CEO Simon Deacon cited a 19% increase in revenue for the first half, with a quoted pipeline of £51 million in potential contracts. LSG’s acquisition of 4G Neon, a UK-based electronics manufacturer, has enhanced its manufacturing capabilities, while the acquisition of Tomtech, a specialist in greenhouse control systems, has expanded its product offerings in controlled environment agriculture (CEA). Deacon noted that government support for sustainability initiatives and increasing demand for energy-efficient solutions in CEA have been driving factors in the company’s growth. LSG is now listed on London’s AIM exchange.

- Local Bounti Corporation (ticker: LOCL), a CEA farmer, reported second-quarter 2024 sales of $9.4 million, up 31% year-over-year. The increase is due to expanded production in Georgia and new operations in Washington and Texas. The company saw a gross profit of $1.4 million and an adjusted gross margin of 29%. Operating loss improved by $5.5 million, while net loss widened to $25.3 million. Fundraising efforts are ongoing, with $3.9 million raised through an at-the-market program during the quarter.

Disclaimer

The information provided on this blog is for general informational purposes only. It is not intended to be a comprehensive analysis of the securities, markets, or developments referred to. While we strive to ensure the accuracy and reliability of the information, the content of this blog does not constitute financial advice, investment advice, trading advice, or any other advice. You should not treat any of the blog’s content as such.

We do not recommend that any securities listed or discussed be bought, sold, or held by you. Nothing on this blog should be taken as an offer to buy, sell, or hold securities. Please conduct your own due diligence and consult with a qualified financial advisor before making any investment decisions.

Forward-looking statements made in this blog are only predictions and are subject to risks, uncertainties, and assumptions that are difficult to predict. Therefore, actual results may differ materially from those expressed in forward-looking statements. We expressly disclaim any obligation to update or alter statements whether as a result of new information, future events or otherwise, except as required by law.

August Indoor Ag Update: M&A Galore & Indoor Specialty Crops Funding

July Indoor Ag Update: Acquisitions Accelerate & Funding Returns

Five Farms Making a Go of Indoor Agriculture

Dyson’s 250% Yield Breakthrough Headlines June AgTech: Vertical Farming Advances, M&A Activity, and Industry Setbacks

Indoor Agriculture Pivots to Home Gardens as Vertical Farming Failures Drive Strategic Reevaluation

Zordi Series B and May 2025 Indoor Agriculture Developments

Freight Farms Bankruptcy and iUNU’s $20M Raise Highlight April’s Indoor Ag Contrasts

Freight Farms Resources: Indoor Ag Companies Stepping Up to Support Freight Farmers

How to Finance Your Hydroponic Project in 2025: Finding Opportunity in a Shifting Market

Indoor Ag’s New Reality: Practical Advice from Investment Banker Adam Bergman

Plenty Unlimited bankruptcy dominates March’s indoor ag news, overshadowing new farm plans