January 6, 2025

In the not-so-distant past of 2020-2022, indoor farming attracted significant venture capital interest. Investors poured millions into vertical farms, as distinct from greenhouses, drawn by promises of tech-driven profitability and year-round leafy greens. The indoor ag outlook has since shifted dramatically.

The closure of vertical farming major Plenty’s California facility in late 2024 marked the end of an era. The last large-scale leafy green vertical farm in the US shuttered its doors, underscoring the economic challenges faced by this model.

2024: A Year of Transformation

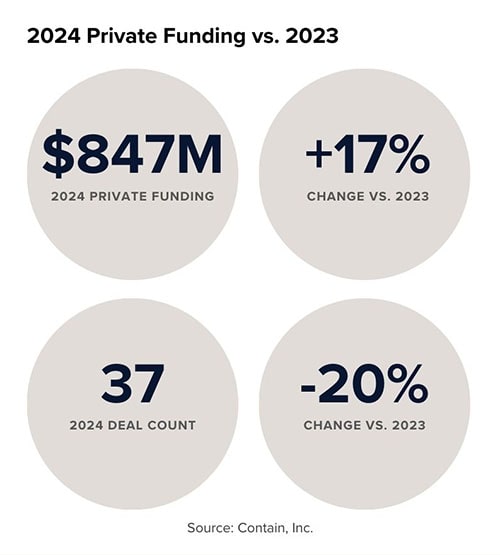

In the context of a rough VC funding market, indoor agriculture funding showed some resilience in 2024. Total investment reached $847 million across 37 rounds, up 17% from $726 million in 2023. Notably, debt financing jumped to $461 million, accounting for 54% of total funding, compared to just $21 million in 2023.

This shift in funding composition reflected a broader trend towards less dilutive capital in a tighter equity market. Debt, private equity and government funders have stepped in to replace VC. Their investment requirements tend to be more conservative, preferring established businesses. So, later-stage investments gained prominence, with Series C funding growing from $34 million to $117 million.

The industry began to mature. Berries become the ‘it’ crop. Companies explored diverse approaches beyond traditional crop production. For instance, Square Roots pivoted to “Plant Biology as a Service,” leveraging indoor farming expertise for plant research and development.

M&A Reshapes the Industry

2024 saw consolidation in the indoor agriculture sector. A prime example is Cox Farms, a subsidiary of communications giant Cox Enterprises. Cox Farms emerged as one of North America’s largest greenhouse operators, doubling its acreage to over 700 acres in just nine months through strategic acquisitions. This included facilities like Greenhill Produce’s 150-acre operation in Ontario.

Innovation Continues

While the days of funding startup leafy green vertical farms may be behind us, investment in innovation persists. For example, Hippo Harvest secured $21 million in Series B funding to adapt general-use robots for greenhouse applications.

Looking Ahead: 2025 and Beyond

Looking into 2025, our indoor ag outlook is cautiously optimistic. With global private equity dry powder at $1.2 trillion and private credit expected to expand to $2.6 trillion by 2029, funding availability may improve. In turn, this favors established greenhouse expansion on the one hand, and further M&A to reach scale on the other.

At the early stages, the industry is likely to favor those pushing the envelope with new crops and innovative business models. At Contain, we now see pitch decks for more interesting business models that tackle indoor farms’ economic challenges of electricity and labor costs head on. We see models like vertical farms co-located with data centers, using excess heat to nurture crops and those looking to bring high value, high demand crops into greenhouse cultivation.

The story of indoor farming is far from over. It’s evolving, adapting, and finding new ways to flourish. While the days of leafy green mania may be behind us, the industry is writing a new narrative – one of resilience, innovation, and a focus on sustainable growth and profitability.

For those seeking more details of the indoor ag outlook, our full briefing paper offers a deeper dive into the numbers, trends, and predictions shaping the future of indoor agriculture. It can be downloaded for free at our Insights hub.

November 2025 Indoor Ag Update: Vertical Farming Raises While Public Markets Stumble

October Indoor Ag Update: Signs of Life in New Indoor Farms and Better Equipment Sales

September Indoor Ag Update: Vertical Harvest Secures Middle East Investment & Market Consolidation

August Indoor Ag Update: M&A Galore & Indoor Specialty Crops Funding

July Indoor Ag Update: Acquisitions Accelerate & Funding Returns

Five Farms Making a Go of Indoor Agriculture

Dyson’s 250% Yield Breakthrough Headlines June AgTech: Vertical Farming Advances, M&A Activity, and Industry Setbacks

Indoor Agriculture Pivots to Home Gardens as Vertical Farming Failures Drive Strategic Reevaluation

Zordi Series B and May 2025 Indoor Agriculture Developments

Freight Farms Bankruptcy and iUNU’s $20M Raise Highlight April’s Indoor Ag Contrasts

Freight Farms Resources: Indoor Ag Companies Stepping Up to Support Freight Farmers